Latest Releases

Why Trust SCM Direct with your investments

How does SCM Direct differ from other investment management companies / its competitors?

We believe SCM Direct has a number of fundamental differentiators.

Co-invested – On the Same team

Our Founders invest a significant amount of their own money alongside clients, on exactly the same terms and fees. We have no external shareholders so are not conflicted. With considerable ‘skin in the game’, we believe we offer investors a robust investment option.

100% Transparency of Fees and Holdings

At this moment in time, in terms of fees and costs, SCM Direct is the only investment house that publishes a true Total Cost of Investing number on our website and monthly factsheets, in one understandable number – so there are no hidden fees whatsoever.

We believe it is a basic consumer right for investors to see the full impact of all fees, at all levels on their investments – after all it is their money. This means SCM Direct operates with no hidden entry / exit fees, or other hidden charges that eat away at clients’ returns.

We also believe in keeping things simple and understandable so have no minimum holding period, no hard sell, no glossy product launches. We pride ourselves on 100% transparency of holdings and give clients 24 / 7 access to all their holdings, in all portfolios.

Efficiency

As a disruptive innovator, we have embraced technology to enable efficiencies, through a fully automated back office, custody, administration and dealing. We operate with a very flat corporate structure, and clients benefit from our efficiency, especially in comparison to many traditional private client operations, wealth managers and adviser firms. We think of ourselves as the Netflix of the investment world.

Track Record

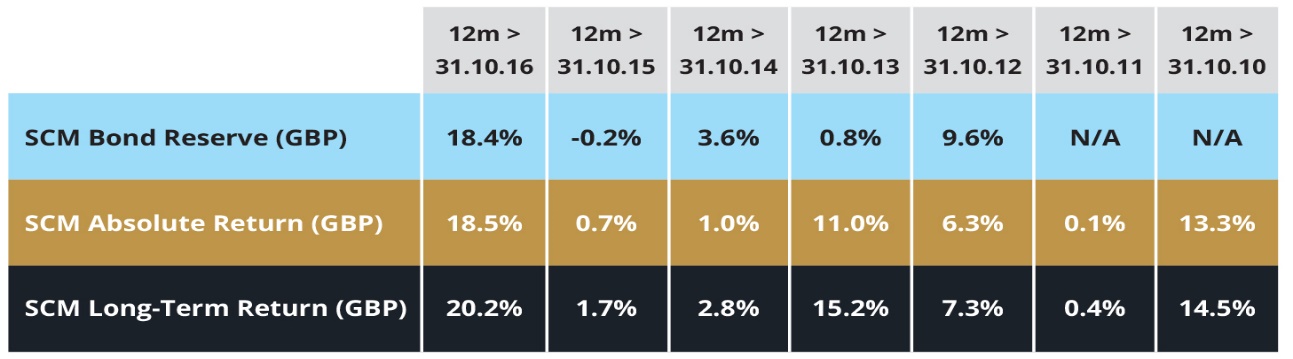

Having started in 2009, we believe we possess one of the longest actively passive investment track records in the UK for our investment portfolios; especially in the new competitor investment landscape, often referred to as Fintech or Robo Investing.

The SCM Absolute Return and Long-Term Return portfolios commenced on the 8th June 2009.

The SCM Bond Reserve portfolio commenced on the 1st June 2011.

Source: SCM Private LLP based on third party performance data from Investment Software Ltd & SGSS.

Past performance should not be seen as a guide to future returns. The value of investments and the income from them can go down as well as up and investors may not recover the amount of their original investment.

In terms of the personal track record of our Chief Investment Officer (CIO), he is one of a handful of highly respected fund managers whose unique 28 years’ track record has resulted from managing money for a wide range of clients – retail, institutional and private – across a wide range of asset classes – equities, property, fixed interest, hedge funds and alternative assets.

What do you feel is the most important measurement of success for SCM Direct?

The most important measures will be made by others, not us; client satisfaction – in the form of happy clients achieving the investment returns they require, consistently – year after year.

As well as testimonials, recommendations, and awards such as these which we are very proud of:

What can a client expect from your firm in terms of communications and reporting?

Clients have online access to their portfolios 24/7 and can drill down to all the holdings, at last night’s prices. We also operate a two-way secure messaging service, as well as sending out a monthly update containing Market Commentary, Portfolio Activity and Performance Factsheet – although everything is available online.

Our efficient, flat structure means all members of our team are only ever an email or call away – including the Chief Executive and Chief Investment Officer.

If, for whatever reason, a client is not happy and wants to close their account with us, they simply send us a secure email instruction and money is normally back in the client’s bank account in 3 -5 working days – no quibbling, not tons of paperwork. The same applies to withdrawing funds – as long as the account stays above the minimum investment level of £15,000 (for UK clients). For client’s resident aboard the minimum is €150,000 or $150,000 US.

How would you describe the distinctive features of your firm’s investment philosophy?

We follow logic and fundamentals. We are not interested in fashion or hype or herd thinking. We operate with a contrarian mind-set and are not afraid to swim in the opposite direction of other managers. The hardest thing to do is to sit on our hands, but sometimes this is the smartest decision, rather than be a busy fool.

Our overall philosophy is that nothing is certain but we can substantially improve the probability of winning by being more contrarian, better diversified, and being cost conscious as fees are the biggest eroder of returns.

Gina Miller, Founding Partner – SCM Direct

Tagged Gina Miller, SCM Direct